The fatalism of the inflation debate

Nothing in the economy is ‘inevitable’. We can change things if we want to.

Want to read spiked ad-free? Become a spiked supporter.

Britain’s top unelected policymaker, Andrew Bailey, the governor of the Bank of England, spoke to the House of Commons Treasury Committee on the same day that the high inflation figures for last December were published. Although the timing was coincidental, his comments on inflation show why this issue has become such a focus for economists and economic commentators, as well as for state functionaries like Bailey. And the reasons go deeper than sympathy with the many who have already been hit hard by rising living costs.

A debate has been raging in recent months between ‘Team Transitory’ and ‘Team Permanent’ over the transience or otherwise of higher inflation. In particular, those who think the higher rates may persist have been critical of central banks for failing to tighten monetary policy earlier. Critics accuse central bankers of failing in their core responsibility for maintaining price stability, generally defined since the 1990s as keeping inflation in the region of two per cent.

On the face of it, though, the attention and jitters in British economic circles generated by a five per cent-plus inflation figure, and similar discussions in America and other advanced industrialised countries, seem a bit exaggerated. We are hardly on the road to the destabilising hyperinflation of the Weimar Republic in the 1920s, or of contemporary Venezuela. How can we account for what some have dubbed this ‘great inflation debate’?

Sure, average UK consumer prices are now rising faster than at any time since 1992, when inflation was coming down from a high of just over eight per cent in 1990. However, when it was still above five per cent, in 2008 and again in 2011, there was nothing like this amount of apprehension about the scourge of inflation. Even a spike to seven or eight per cent in consumer inflation, which some forecasters anticipate for April this year when the home energy price cap is expected to jump again, is not that elevated, historically speaking.

The current peak, for instance, is about half the double-digit rate across the late 1970s period of stagflation (when high inflation is accompanied by falling output). And it is not only levels of inflation that separate us from the 1970s. That was also a period characterised by politicised class conflict in workplaces around the developed world.

And while a seven or eight per cent level of inflation this spring would still be three or four times the central bank target, even most pessimistic forecasters anticipate a significant fall later in the year to three or four per cent – or maybe even less.

It is worth recalling that until very recently, commentators were concerned about inflation being too low. Many were critical of central banks in Europe, Britain and the US for not reaching their two per cent targets for most years since the financial crisis, and for considerably longer in Japan. Indeed, a fairly common sentiment from economists before the pandemic was that a period of three per cent-plus inflation would be a helpful corrective.

Yet when inflation did rise above the two per cent level, those same economic commentators started presenting it as one of the biggest economic problems of our times.

It is not as if what has happened to prices since last summer is so hard to rationalise given what the world economy has been through during the past two years of the pandemic. Governments’ decisions to repeatedly shut down and then open up their economies were bound to be hugely disruptive to economic activity. It is hardly surprising that all sorts of data have gone haywire, with records set on the way down, and then in the subsequent bounce-backs. Movements in output and prices have been impacted upon not only by measurement distortions, but also by significant supply and labour-market disruptions within production, as well as in transporting goods around the world.

Of course, it is conceivable that other persisting inflationary factors might be at play, too. For instance, thanks in part to Net Zero policies, high energy prices could go higher still or remain permanently high – though in the latter case they would drop out of year-on-year inflation rates while continuing to be a huge burden on household living costs.

But until the transient pandemic-related drivers work themselves through the economy over the next couple of years, it would be unwise to overinterpret current statistics. To view economic challenges through the perspective of movements in consumer prices is a narrow, superficial and mystifying approach at the best of times, never mind in this period of self-imposed economic turbulence.

Bailey’s comments do help to explain the mainstream focus on inflation. For a start, the backdrop to his comments was not just the rise in consumer inflation but the previous day’s announcement that prices were rising significantly faster than earnings. The recognition of a cost-of-living squeeze, and the anxiety this causes among policymakers fearful of an active public backlash, whether justified or not, is certainly a contributor to the discussion within the media and the political classes.

Bailey also suggested that cost-of-living pressures were not just a result of inflation; they might also help to weaken inflation. Higher inflation and falling real incomes will ‘tend to restrain demand in the economy’. This, he continued, might lead to higher unemployment that could bring inflation down again. At one level this expresses the conventional surface-level notion that growth is demand-led, rather than driven by the locomotive of production. But something else is being revealed here, too.

Bailey is succumbing to an increasingly prevalent economic fatalism. He depicts economic phenomena as the products of economic forces which operate quite apart from us – in this instance, inflation will be reduced by cost-of-living pressures. It assumes that economic outcomes are driven by the supposed inner dynamics of the ‘market’ as an autonomous force, rather than by what people – workers, business leaders or policymakers – might do.

Inflation as a category falls easily into this line of thinking, because it is commonplace to explain rising prices by rising prices, giving it the appearance of a self-perpetuating phenomenon. Household energy prices go up, because wholesale gas prices have gone up. The prices of imported goods have gone up, because global transportation costs have gone up. And so on.

It is true that there has always been a determinist, sometimes naturalist, aspect to economic discussions, but this has become accentuated in recent times. Capitalism thus appears to operate with increasingly limited scope for human leverage.

This fatalism lets off the hook state policy, which has caused new problems and made others worse. And by downplaying the role of policy levers in general, it makes it look as if there is little that can be done to influence, never mind fix economic problems.

Central bank officials are especially sensitive to this presentiment of limited power because of the elevated role they have been given since the 1990s. After the official discrediting of fiscal policy, and of government economic intervention in general, during the late 1970s and 1980s monetary policy conducted by so-called ‘independent’ central bankers became regarded as the main legitimate lever of economic policy. Politicians of all stripes were happy to relinquish direct responsibility for the economy and delegate it to these unelected officials. Central bankers were expected to manage national economies with the overall objective of ensuring financial and economic stability.

However, over the past two decades, and especially since the 2008 financial crisis, the central-banking community has become increasingly aware of its restricted ability to make much difference to important economic activities and outputs, such as business investment, productivity and employment levels. Many, including the central bankers themselves, have expressed concern that the monetary policy tools of modifying interest rates and credit conditions have become less effective for managing the economy. Indeed, the economy increasingly appears to central bankers as an independent force, almost impervious to their actions as it lurches from crisis to crisis: from sovereign debt troubles, to taper tantrums, to financial asset bubbles, all against a backdrop of, at best, mediocre growth.

Central bankers seem to have internalised a sense of impotence. For instance, speaking at a forum organised by the European Central Bank last September, Bailey emphasised quite reasonably that in response to pandemic disruptions ‘monetary policy can’t solve supply-side shocks. Monetary policy can’t produce computer chips, can’t produce wind, can’t produce truck drivers.’

Central bankers are also acutely aware that they have no easy policy choices – even though they remain reluctant to accept their own role in fuelling today’s financialised and debt-dependent economy. Tighten policy and central bankers might trigger debt defaults, financial market turmoil and a return to recession. Fail to tighten, with inflation relatively high, and they fear losing not just control of inflation but also what credibility and authority they still retain.

This absence of any good policy options explains why central bankers have been so hesitant to reverse the exceptional easing measures they introduced after the financial crisis. The tentative tightening steps they are now taking show that their angst about contemporary inflation is less to do with rising prices per se, and more a sign of them feeling less in control of an economy that seems ever more difficult to understand.

This broader fatalism in the face of fundamental economic challenges in productivity and decent job creation is a bigger problem even than today’s cost-of-living squeeze, as real and harsh as that already is for lots of families. Inflation is always an outcome, a symptom of other more important issues to address. And if the people who should be in authority fail to act decisively to address these issues – instead of offering a Treasury-backed sticking plaster here, or an interest rate tweak there – then their deeper causes will fester, and financial hardship will persist and potentially get worse. Not least when existing policies aggravate the economic malaise.

When it comes to the misery of falling living standards, what is needed isn’t a fevered debate around rising prices and some short-term counter-inflationary devices, but a proper plan for economic growth. The wealth from rising productivity is the only reliable source of durable prosperity. Moreover, it would allow society to deal better with material disruptions of the sort we have had to endure over the past two years of restrictions and lockdowns.

Phil Mullan’s Beyond Confrontation: Globalists, Nationalists and Their Discontents is published by Emerald Publishing. Order it from Emerald or Amazon (UK).

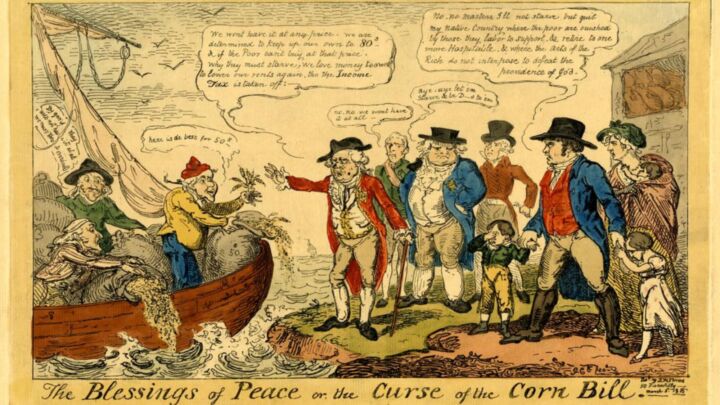

Picture by: Getty.

Who funds spiked? You do

We are funded by you. And in this era of cancel culture and advertiser boycotts, we rely on your donations more than ever. Seventy per cent of our revenue comes from our readers’ donations – the vast majority giving just £5 per month. If you make a regular donation – of £5 a month or £50 a year – you can become a and enjoy:

–Ad-free reading

–Exclusive events

–Access to our comments section

It’s the best way to keep spiked going – and growing. Thank you!

Comments

Want to join the conversation?

Only spiked supporters and patrons, who donate regularly to us, can comment on our articles.