Capitalism after the ‘credit crunch’: what is it good for?

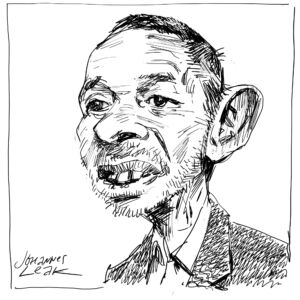

In the run-up to a debate at the Battle of Ideas, Frank Furedi takes on capitalism’s half-hearted advocates and its misanthropic critics.

Want to read spiked ad-free? Become a spiked supporter.

This weekend, Frank Furedi will be speaking at a debate on capitalism in crisis at the Battle of Ideas, the two-day festival of debate on politics, economics, culture and life organised by the Institute of Ideas. Here, Furedi argues that the current ‘credit crunch’ has exposed a far more profound crisis of meaning. Buy your tickets for the Battle of Ideas here.

Society has found it increasingly difficult to interpret or give meaning to the current global recession. So far, the dominant response has been to seek refuge in mechanistic, formulaic phrases: ‘The world will never be the same again.’ That tired old line, echoing similar facile pronouncements made after 9/11, is of course so vague and meaningless that it can never be proved wrong.

There have been numerous variations of this portentous diagnosis. Joseph Stiglitz argues that recent events will be to ‘market fundamentalism what the fall of the Berlin Wall was to communism’. President Nicolas Sarkozy of France says American-style capitalism is finished, soon to be replaced by a more benign etatist alternative. Alan Greenspan, former chairman of the Federal Reserve and one of the public figures most associated with neo-liberalism, has acknowledged that he ‘made a mistake’ and that, quite possibly, the markets do not regulate themselves.

Reading the numerous obituaries to neo-liberalism, it is difficult to work out precisely what has come to an end. Sarkozy says that ‘laissez-faire is finished, the all-powerful market that is always right, that’s finished’ – yet this merely restates the widely accepted prejudice that neo-liberalism actually ran the world during the past two decades. In fact, contrary to this myth, it is inaccurate to characterise the recent era as one of ‘laissez-faire’ capitalism.

To be sure, since the 1980s there has been a lot of talk about neo-liberalism and free market economics. But the global economy was not transformed into a deregulated paradise for ruthless profiteers. Yes, deregulation was widely acclaimed, but its implementation was confined to the banking and financial sectors. Nor was the massive expansion of credit in the late twentieth century the direct and spontaneous outcome of the workings of the free market. The American and British housing bubbles were underwritten by the political intervention of the state. Governments pursued loose monetary policies to provide consumers access to cheap credit. It was the Federal Reserve, not the markets, that established a regime of low interest rates which made possible the reckless expansion of credit.

It is tempting to blame the deregulated financial markets for unleashing today’s powerful destructive global forces. Yet the deregulated financial markets did not emerge directly from the market; they were the product of political decisions and of various kinds of wheeling-and-dealing. Governments were more than happy to accommodate to the interests of the banking and finance sectors. The expansion of credit provided governments with tax revenues that could be used to support public expenditure. The recent era of easy money, of parasitically living off borrowed wealth, was as much an outcome of short-termist political opportunism as it was of greed-driven markets.

Despite the Reagan and Thatcher governments’ promotion of monetarist policies, the state continued to be a key player in the economic life of global capitalism during their rule and after it. Even before the arrival of the so-called ‘credit crunch’, state expenditure played a massive role in the economic life of Western capitalist societies. It is worth recalling that in 2007, state expenditure in Britain accounted for 44.7 per cent of gross domestic product. Even in the US, the home ground of so-called neo-liberalism, state expenditure accounted for 37.4 per cent of GDP. And it seems likely that these figures will turn out to be underestimates, as an increasing amount of public spending is ‘off balance sheet’.

It is odd that the last phase of credit-led expansion has come to be associated predominantly with the ideas of market fundamentalism and deregulation. For this is a period in which there has been a steady growth of state and bureaucratic regulation of industrial activity, scientific experimentation, technological innovation and anything that might remotely impact on the environment. The truth is: the recent phase of global economic expansion was inextricably bound up with state intervention.

History shows that during times of boom and prosperity, bankers, businesspeople and politicians can lose sight of the realities of economic life. Some public figures get so carried away with their fantasies that they end up equating the paper economy with the real one. From time to time, politicians believe their own hype, though UK prime minister Gordon Brown will be remembered as being in a class of his own for his promise to ‘end’ boom and bust.

However, the illusions that defined the conventional wisdom of recent times were internalised by both the so-called market fundamentalists and their opponents. We should remember that the ideologues of the ‘anti-capitalist’ and environmental movements have warned the public about the dangers of an ever-growing turbo-capitalism. As far as they were concerned, the problem was the expansionary dynamic of the system, its limitless ambition, and its ability to increase production and consumption continually. Like Brown, they were captivated by the idea of a permanent boom, and thus overlooked the barriers to global economic expansion. Their critique of neo-liberalism did not fundamentally question the capitalist system, only its capacity to distribute resources equitably. As far as the critics of capitalism were concerned, the system worked, but unfairly.

Whatever illusions the neo-liberals may have had in the power of their system, it was more than shared by their naive anti-consumerist critics. They were so intoxicated by their own myth of globally dominant neo-liberalism that they came to believe that capitalism’s potential to keep growing was an iron law of history. The Australian anti-consumerist critic Clive Hamilton predicted that ‘modern consumer capitalism will flourish as long as what people desire outpaces what they have’. For Hamilton, the problem was that neo-liberalism works too well. ‘The fact is that neo-liberalism has fulfilled its promise of prosperity, delivering a large increase in income across the board’, he argued (1).

Who needs market fundamentalists when their critics’ analysis of economic life is so fundamentally wrong? In reality, the current global economic crisis indicates that prosperity is a transient and ever-elusive commodity.

Capitalism’s fickle friends

It is not surprising that the terms ‘neo-liberal’ and ‘market fundamentalists’ now have such negative connotations. Even before the credit crunch, capitalism had few high-profile intellectual advocates. Indeed, what has been most striking about our recent era of alleged neo-liberal triumphalism is the feeble moral, cultural and intellectual support that capitalism has enjoyed. At best, it has been begrudgingly accepted. It is more frequently denounced for its excess and for encouraging a destructive consumerist culture. At a time when the ideal of sustainability enjoyed widespread cultural affirmation, a system wedded to economic expansion was always going to be short of friends.

Capitalism was unable to take the moral high-ground before the current recession; so its advocates are likely to face formidable obstacles when they try morally and culturally to rehabilitate it in the years ahead. In retrospect, it is striking how, despite its considerable economic success, capitalism has not succeeded in developing a system of intellectual support for itself. To understand this problem, it is worth reviewing the historical origins of the intellectual crisis of capitalism.

The ideals associated with laissez-faire swiftly became discredited the last time global capitalism faced a major crisis. By the late 1930s there was an intellectual consensus, supported by virtually the entire ideological spectrum, that the notion of free-market capitalism was not sustainable. The moral and intellectual malaise of the time was so profound that many leading thinkers in the West believed that, unlike their sick economy, the economy of the Soviet Union was going from strength to strength. With hindsight, however, it is clear that it was the absence of confidence in the West, caused by perceptions of the weakness of the capitalist system, which meant many Western thinkers had such exaggerated views about the progressive potential of the Soviet Union.

Intellectual trends in the 1930s and 40s, like today, were deeply hostile to the ideals of economic liberalism. Planning was seen as an intellectually acceptable strategy, while free-market economics had an outdated and stale image. Friedrich Hayek, probably the most renowned intellectual advocate of the free market and widely hailed as the father of neo-liberalism in the 1980s, sounded much more tentative four decades earlier. Anyone re-reading his book The Road to Serfdom will be struck by its tone of defensiveness. ‘It is no longer fashionable to emphasise that “we are all socialists now”; this is so merely because the fact is too obvious’, he complained, before predicting that ‘scarcely anybody doubts that we must continue to move towards socialism’.

Hayek’s arguments against planning conveyed a sense of hesitancy. Planning is not inevitable, he said with a sense of resignation. But he is prepared to accept that some form of rational planning is unavoidable and insists that he is not a supporter of dogmatic laissez-faire. He pleads: ‘The fact that we have to resort to the substitution of direct regulation by authority where the conditions for the proper working of competition cannot be created, does not prove that we should suppress competition where it can be made to function.’ (2) And this from the most articulate and vociferous opponent of planning in the 1940s!

One by-product of the general loss of faith in capitalism was the creation of a new consensus around the acceptance of planning and the creation of a mixed economy committed to welfare provision. This was a response to the perception of capitalist weakness and the ideological alternative posed by the Soviet Union. Its most articulate advocates were New Deal liberals in the US and social democrats in Europe. However, this consensus drew upon a far wider constituency; it included many conservative thinkers in Britain and individuals who would be associated with Christian Democracy after the Second World War.

Throughout the Cold War era, capitalist societies found it easier to gain legitimacy through mobilising support against the Soviet threat than by encouraging a positive identification with a clear system of values. This was a problem that exercised the energies of the sociologist Daniel Bell who in his seminal work The Cultural Contradictions of Capitalism (1976) grappled with the question of why capitalism failed to generate any cultural or intellectual system of support. He observed that the ‘traditional bourgeois organisation of life – its rationalism and sobriety – has few defenders in the serious culture; nor does it have a coherent system of cultural meanings or stylistic forms with any intellectual or cultural respectability’ (3).

At least provisionally, the problem raised by Bell was suspended during the Reagan/Thatcher era. During this period, the ideas associated with economic planning, the mixed economy and the welfare state became undermined by the crisis of state expenditure of the 1970s (see The myth of Thatcherism, by Brendan O’Neill). For a brief moment, Thatcher’s celebration of TINA (There Is No Alternative) seemed to suggest that liberal capitalism stood vindicated by experience. However, on closer examination TINA was another form of negative affirmation of the capitalist system. It was a way of saying that there is no other game in town rather than an argument for endowing capitalism with moral authority. Nevertheless, in the circumstances of Thatcher’s time, the celebration of TINA could foster the illusion of triumph – an illusion that was internalised as much by the critics of liberal capitalism as by its adherents.

As everyone knows, capitalism has survived a series of crises during the past two centuries. It has shown that it has an alarming capacity to disrupt and destabilise everyday life, and also a formidable potential for growth and innovation. In the past, people have sought to minimise the damage caused by this system’s destructive tendencies while maximising the benefits accrued through growth. From this perspective, a crisis works both as a problem and as a potential resolution to a problem. Today, as in the past, we feel the pain of a capitalist crisis. However, unlike in previous eras, there is widespread hesitancy about reorganising the system so that it can work to its potential. Most critics of neo-liberalism are driven by their dislike of, and estrangement from, modernity; they have very little to say about the real workings of capitalism. Of course, the alternative of permanent austerity is unlikely to inspire very many outside of a small coterie of green reactionaries and survivalists. And the critics of neo-liberalism are less than enthusiastic about explicitly pursuing their etatist alternative because memories of the failure of the old mixed economies are still fresh in their minds.

In these confused times, we should attempt to defend capitalism from its small-minded opponents. While they occasionally manage to make useful criticisms about some of the irrationalities of the system of finance and banking, they show little real understanding of the workings of the capitalist system. More fundamentally their attack is inspired by a reactionary impulse that fears change and despises human progress. Through their attitudes and behaviour, they legitimise the dogma of TINA, for how can a backward-looking rejection of modernity offer a plausible alternative to anything?

What the current crisis indicates is that we have to rethink the categories and ideas through which we make sense of the human condition. Capitalism was and remains a system driven by expansion. Through the accumulation of capital this system of production has encouraged innovation, technological development and raised living standards, albeit unequally throughout the world. Periodically, capitalism is forced to come up against the barriers to its further development. As a result, this is a system of booms and busts, and the busts are sometimes transformed into a crisis of historic proportions. Until now, the capitalist system has always succeeded in overcoming the barriers to its further development. Through global expansion and the export of goods and investment it has overcome the limits set by its domestic economies. From time to time it has restructured and rationalised its economies, but at a great cost to sections of society. In recent decades it has developed a system of finance and credit that could underwrite economic growth on a global scale. The impressive scientific and technological progress of the past 30 years were in part financed through the easy-money regime.

Now capitalism has come up against new barriers – ones that are far more global than in previous times. The question that this development poses is: how do we deal with this crisis? Every crisis interrogates society’s capacity to deal with unexpected challenges. The answers society comes up with will play a decisive role in influencing how people experience and understand the recession. Every crisis is a crisis of meaning and of ideas. The way we respond can either contain the destructive effects of this crisis, or amplify them.

What is important is that we do not look for quick-fix technical solutions. What we need is not just more effective fiscal and monetary policies but clarity about the kind of world we want for our children. These days, ideals and idealism get a bad press. And we know from history that, in practice, we fail to achieve most of our ideals. However, ideals about the world we would like to create help to focus the mind. They motivate society to think beyond the short-termist agenda of damage limitation. Most important of all, they give society something positive to think about and achieve.

Frank Furedi’s Invitation To Terror: The Expanding Empire of The Unknown is published by Continuum Press. (Buy this book from Amazon(UK).) He is speaking in the session Capitalism – what is it good for? at the Battle of Ideas festival at the Royal College of Art, London on 1&2 November. Visit Furedi’s website here.

The state won’t be the saviour of the economy, by Frank Furedi

I don’t predict a riot, by Mick hume

This Marxist isn’t laughing, by Brendan O’Neill

Against austerity, by Brendan O’Neill

There Is (still) No Alternative, by Mick Hume

Congress bales out, by Brendan O’Neill

Scapegoating the spivs, by Tim Black

It’s the politics, stupid, by Phil Mullan

Lehman Brothers: when confidence runs out, by Rob Lyons

Five myths about the Wall Street crisis, by Daniel Ben-Ami

Read more at spiked issue: Financial Crisis.

(1) See Clive Hamilton ‘What’s Left? The Death of Social Democracy’ in Quarterly Essay, issue no 21, 2006, p.34

(2) F. Hayek (1976) The Road To Serfdom, Routledge and Kegan Paul : London, p.29

(3) D. Bell (1980) Sociological Journeys: Essays 1960-1980, Heinemann : London, p.302.

Who funds spiked? You do

We are funded by you. And in this era of cancel culture and advertiser boycotts, we rely on your donations more than ever. Seventy per cent of our revenue comes from our readers’ donations – the vast majority giving just £5 per month. If you make a regular donation – of £5 a month or £50 a year – you can become a and enjoy:

–Ad-free reading

–Exclusive events

–Access to our comments section

It’s the best way to keep spiked going – and growing. Thank you!

Comments

Want to join the conversation?

Only spiked supporters and patrons, who donate regularly to us, can comment on our articles.