Making sense of the stock-market turmoil

There’s too much complacency about our abnormal economy.

Want to read spiked ad-free? Become a spiked supporter.

The recent stock-market turmoil has prompted a huge amount of financial media analysis. If you’ve been following it all, there’s a possibility that you may have been less enlightened than you had been hoping for.

Explanations have been wide-ranging. They have included a fear of inflation triggered by a small uptick in US monthly wage growth, to the expansion of ‘passive’ financial investment techniques that exacerbate the strength of any price shifts. There were lots of mentions, too, of Donald Trump’s tax changes, though less agreement on which effects might be pertinent. Some observers emphasised a possible boost to US economic growth bringing forward official interest-rate increases, while others wrote of the boost to the budget deficit making it more expensive for the government to borrow.

You will have certainly read a lot about the return of financial ‘volatility’. And about how this apparently took some people by surprise, wiping out the value of their low-volatility-dependent financial instruments. And if you had felt reasonably familiar with the three-letter acronyms that peppered analysis of the 2008 financial crisis you have now discovered there are more to unpick. Instead of, or rather on top of, CDOs (collateralised debt obligations) and MBSs (mortgage-backed securities) from back then, we have new ones to get our heads around.

Innovation in the world of production may be moving a lot slower than is implied by all the talk of relentless disruption, but financial ‘innovation’ is as evident as it was in the years leading up to 2008. In the somewhat free-floating world of financial bits and bytes, there are no limits to traders coming up with new ways they can make money, even if the punters they sell them to might be less lucky.

So now we read about ‘ETPs’. These are ‘exchange traded products’, some of which tanked when volatility jumped. And we hear about ‘CTAs’. These are ‘commodity trading advisers’, not completely new, but they have become more prominent in the world of financial futures trading. They are features of the ‘big data’ era, using computer-driven data analysis to follow, and hopefully cash in on, asset price trends.

One of the more fanciful explanations was that ‘the markets were testing’ Jerome Powell, the new chairman of the US central bank. It is true he did take over the Federal Reserve last Monday, 5 February, the same day share prices first fell sharply. However, no one has yet divulged where these ‘markets’ got together to agree their dastardly plan to put Powell under pressure.

Enough of the coverage. Of course there is always a specific catalyst for significant stock-markets falls. Identifying it can be rewarding for making the workings of financial markets appear more tangible. For instance, understanding the role of sub-prime mortgages in 2006/2007 helped bring to life what a modern debt society really means, for people and for the system.

However, it is as yet premature to follow the more forensic analysis of last week too closely. With the passage of more time, it is likely some shrewd investigators will uncover the specific features of the late 2010s financial crash. When the turmoil turns into something more permanent, which could be this week, or it could be next month, or some time within the next year or so, unearthing its particular trigger may be equally instructive.

Now, though, is one of those occasions when the simplest explanation is probably the best guide to what’s going on. The strains in financial markets are because they have been artificially high. What goes up too much won’t stay there. More than ever before, financial markets are disconnected with what is happening in value production across the mature industrial countries. It’s like stretching a piece of elastic that at some imprecise moment snaps back.

The reason asset prices, especially equity ones, got so high is also simple. The world’s central banks, dominated by the big three of the US, Japan and the Eurozone, have for years been buying up financial assets in pursuit of their post-crash quantitative easing (QE) programmes. Ever since late 2008, this has been the key driver of financial markets.

The combined balance sheets of the top three banks jumped from about $4 trillion then to nearly $15 trillion now. Last year alone the leading banks pumped in $2 trillion. That’s a lot of buying power. We don’t need to look any further for why financial prices were ballooning and why their volatility was low. The state banks have been the huge buyers that the private financial institutions have been selling to.

Next time you hear someone talking about the triumph of ‘neo-liberalism’, or the prevalence of free markets, remind them that the financial markets have been explicitly state-dependent for a decade. And this is not some unintended policy side-effect. The central banks got what they wanted. They hoped to push up financial asset prices, both to keep borrowing costs down – financial prices and interest rates generally move in inverse directions – as well as to make people and institutions feel wealthier in the hope they would spend more. It’s proved much easier to stimulate financial wealth than it is to help bring about real new wealth creation through producing more goods and services efficiently.

Today’s underlying market tensions are also because of the central banks. The banks are caught in a dilemma of their own making. Maintaining ultra easy monetary policies could sustain stable and rising financial prices for longer, but at a cost. They know that this strips them of weaponry for intervening when the next recession hits.

Cutting already low interest rates, or extending already extended bank-balance sheets, will have negligible effects. Hence the small, tentative steps they have started to take away from their unprecedentedly easy policies. The main central banks have announced plans either to increase official interest rates a little more and/or see their collective QE liquidity boost start to go into decline towards the end of this year. This is not, as some call it, policy ‘normalisation’. Even if they implement their current intentions, and that’s not a foregone conclusion given the market turbulence, monetary policies will remain most abnormal. This, more than inflated stock markets, is representative of the underlying economic conditions and of their continuing abnormality.

There are therefore no grounds for the complacency that accompanied much of last week’s commentary. A Financial Times editorial heading last week was typical: ‘The market sell-off points to benign causes’. Relying on the fact that most Western economies are growing a little has been turning into proof of renewed industrial strength. How far expectations have fallen. The problems from before 2008 – of weak production activity, low productivity growth and expanding debt – remain. None have been fixed. On the contrary, they are all in a worse state than they were 10 years ago. Financial market fragility is not going away.

Phil Mullan’s latest book, Creative Destruction: How to Start an Economic Renaissance, is published by Policy Press.

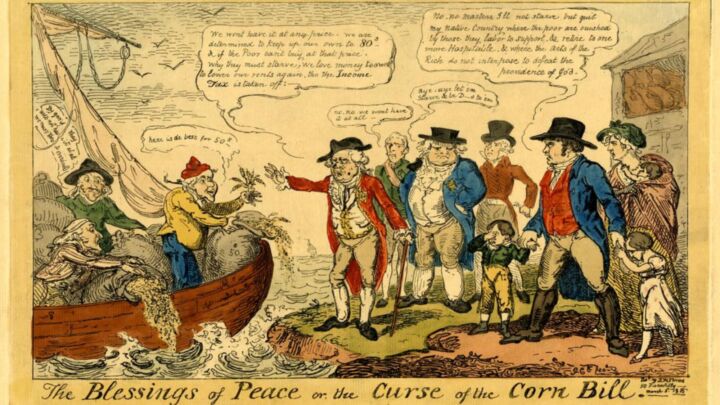

Picture by: Getty Images.

Who funds spiked? You do

We are funded by you. And in this era of cancel culture and advertiser boycotts, we rely on your donations more than ever. Seventy per cent of our revenue comes from our readers’ donations – the vast majority giving just £5 per month. If you make a regular donation – of £5 a month or £50 a year – you can become a and enjoy:

–Ad-free reading

–Exclusive events

–Access to our comments section

It’s the best way to keep spiked going – and growing. Thank you!

Comments

Want to join the conversation?

Only spiked supporters and patrons, who donate regularly to us, can comment on our articles.